Why You Should Select Cooperative Credit Union for Financial Stability

Credit rating unions stand as columns of financial security for lots of people and neighborhoods, providing an one-of-a-kind method to financial that prioritizes their members' well-being. There's more to credit scores unions than just financial perks; they also promote a feeling of area and empowerment amongst their participants.

Lower Costs and Competitive Rates

One of the crucial advantages of credit history unions is their not-for-profit framework, allowing them to focus on member benefits over taking full advantage of profits. Additionally, credit report unions normally supply more competitive interest prices on savings accounts and financings, translating to far better returns for members and reduced loaning costs.

Customized Client Service

Offering tailored assistance and personalized remedies, credit history unions prioritize individualized customer care to satisfy members' specific financial demands efficiently. Unlike standard financial institutions, debt unions are known for cultivating a more personal partnership with their members. This customized method entails comprehending each participant's special monetary scenario, goals, and preferences. Cooperative credit union team typically put in the time to pay attention diligently to participants' concerns and give customized referrals based on their individual needs.

In addition, credit history unions usually go above and beyond to make certain that their participants really feel valued and supported. By constructing solid partnerships and fostering a feeling of area, debt unions develop a welcoming setting where participants can trust that their financial health is in great hands.

Solid Area Focus

With a dedication to supporting and fostering local links area campaigns, cooperative credit union prioritize a strong community focus in their procedures. Unlike standard financial institutions, lending institution are member-owned monetary organizations that operate for the benefit of their members and the neighborhoods they offer. This distinct framework enables credit rating unions to concentrate on the wellness of their members and the neighborhood area as opposed to entirely on producing revenues for outside shareholders.

Credit rating unions often involve in different neighborhood outreach programs, sponsor local events, and collaborate with various other companies to resolve area requirements. By investing in the area, cooperative credit union assist promote local economic situations, produce work possibilities, and improve total quality of life for citizens. Additionally, cooperative credit union are recognized for their participation in financial literacy programs, supplying educational sources and workshops to help area members make informed monetary decisions.

With their solid community focus, lending institution not just supply economic solutions but also work as columns of support and security for the neighborhoods they offer.

Financial Education and Aid

In advertising economic literacy and supplying assistance to people in need, credit unions play a critical function in encouraging neighborhoods in the direction of economic security. One of the essential advantages of credit unions is their focus on supplying financial education and learning to their participants. By providing workshops, workshops, and one-on-one counseling, cooperative credit union assist people better comprehend budgeting, saving, investing, and managing financial obligation. This education and learning equips members with the expertise and skills needed to make educated economic decisions, ultimately resulting in enhanced Credit Union Cheyenne financial wellness.

Additionally, lending institution frequently supply help to participants encountering economic troubles. Whether it's via low-interest lendings, flexible payment strategies, or economic therapy, cooperative credit union are devoted to aiding their participants conquer challenges and attain monetary stability. This individualized technique sets lending institution besides standard banks, as they prioritize the financial wellness of their participants most importantly else.

Member-Driven Choice Making

Lending institution equip their members by permitting them to proactively take part in decision-making processes, a technique called member-driven decision making. This strategy establishes lending institution apart from standard financial institutions, where decisions are usually made by a select team of executives. Member-driven decision making guarantees that the rate of interests and demands of the members remain at the forefront of the credit history union's operations.

Ultimately, member-driven decision making not just enhances the general member experience however also advertises transparency, trust fund, and responsibility within the lending institution. It showcases the participating nature of cooperative credit union and their commitment to offering the very best passions of their members.

Verdict

To conclude, credit report unions supply an engaging choice for financial stability. With reduced costs, affordable prices, individualized customer care, a strong neighborhood focus, and a commitment to economic education and help, cooperative credit union prioritize participant benefits and empowerment. With member-driven decision-making procedures, credit rating unions advertise openness and accountability, making sure a secure financial future for their members.

Credit score unions stand as pillars of financial stability for lots of people and communities, providing a special strategy to banking that prioritizes their members' well-being. Unlike standard financial institutions, credit unions are member-owned financial organizations that run for the advantage of their participants and the areas they offer. Wyoming Federal Credit Union. Additionally, credit report unions are recognized for their participation in economic proficiency programs, supplying instructional sources and workshops to aid area participants make educated economic choices

Whether it's via low-interest financings, adaptable settlement strategies, or economic therapy, credit score unions are devoted to assisting their members get rid of difficulties and accomplish financial stability. With reduced fees, affordable prices, customized client solution, a solid neighborhood focus, and a commitment to economic education and help, credit rating unions focus on participant benefits and empowerment.

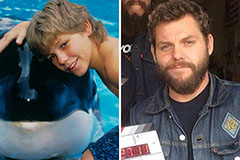

Jason J. Richter Then & Now!

Jason J. Richter Then & Now! Melissa Joan Hart Then & Now!

Melissa Joan Hart Then & Now! Elisabeth Shue Then & Now!

Elisabeth Shue Then & Now! Morgan Fairchild Then & Now!

Morgan Fairchild Then & Now! Sarah Michelle Gellar Then & Now!

Sarah Michelle Gellar Then & Now!